Trend following with systematic position sizing, controlled scalping during high liquidity periods, and swing trading with multi-timeframe analysis have emerged as the three most reliable approaches for funded accounts.

These strategies succeed because they align with prop firm requirements for sustainable performance rather than high-risk, high-reward gambling approaches.

The Strategy Success Framework for Funded Trading

Prop trading strategies operate under fundamentally different constraints than personal account trading, creating a unique environment where traditional approaches often fail spectacularly. Understanding this framework is crucial before diving into specific strategies.

The constraint that changes everything is the drawdown limit. While personal traders might weather a 30% drawdown hoping for recovery, prop traders face account termination at 5-12% drawdowns. This single factor eliminates many strategies that work in personal accounts but prove unsuitable for funded trading.

Consistency requirements add another layer of complexity. Prop firms don't want traders who make 50% one month and lose 20% the next. They prefer steady 3-5% monthly gains that compound over time. This preference shapes optimal strategy selection toward approaches that generate regular profits rather than home-run attempts.

Risk-adjusted returns become more important than absolute returns. A strategy generating 15% annually with 2% maximum drawdowns outperforms one delivering 40% annually with 15% drawdowns in the prop trading environment. This mathematical reality guides successful prop traders toward conservative strategies that might seem boring but prove profitable.

Position sizing precision becomes mandatory rather than optional. In personal accounts, you might risk "whatever feels right" on trades. Prop trading demands mathematical precision in position sizing to ensure worst-case scenarios stay within acceptable limits. This requirement actually improves most traders' performance by removing emotional decision-making from position size selection.

Trend Following: The Cornerstone Strategy

Trend following has established itself as the most reliable foundation for prop trading success, but not in the simple "buy high, sell higher" way many traders imagine. Successful prop trend following involves sophisticated analysis, precise timing, and mathematical position sizing that together create a sustainable edge.

Multi-Timeframe Analysis forms the backbone of the professional trend following. Instead of looking at single charts, successful prop traders analyze trend direction across multiple timeframes to identify the highest-probability setups. This approach significantly improves win rates while providing clear exit strategies when trends change.

The process begins with weekly charts to identify primary trend direction, moves to daily charts for intermediate trend confirmation, and uses hourly charts for precise entry timing. This hierarchy ensures trades align with dominant market forces while providing specific entry points that maximize risk-reward ratios.

Position Sizing Mathematics transforms trend following from gambling to professional trading. Instead of risking arbitrary amounts, successful prop traders calculate exact position sizes based on account value, stop loss distance, and maximum acceptable risk per trade.

The formula is straightforward: Position Size = (Account Value × Risk Percentage) ÷ Stop Loss Distance. If you're trading a $100,000 account, willing to risk 1% per trade, and your stop loss is 50 pips, your position size is automatically determined as 20,000 units. This mathematical approach removes emotion while ensuring compliance with prop firm requirements.

Dynamic Exit Strategies maximize profits while protecting against trend reversals. Rather than using fixed profit targets, successful prop traders scale out of positions as trends develop, taking partial profits at key resistance levels while letting remaining positions run with trailing stops.

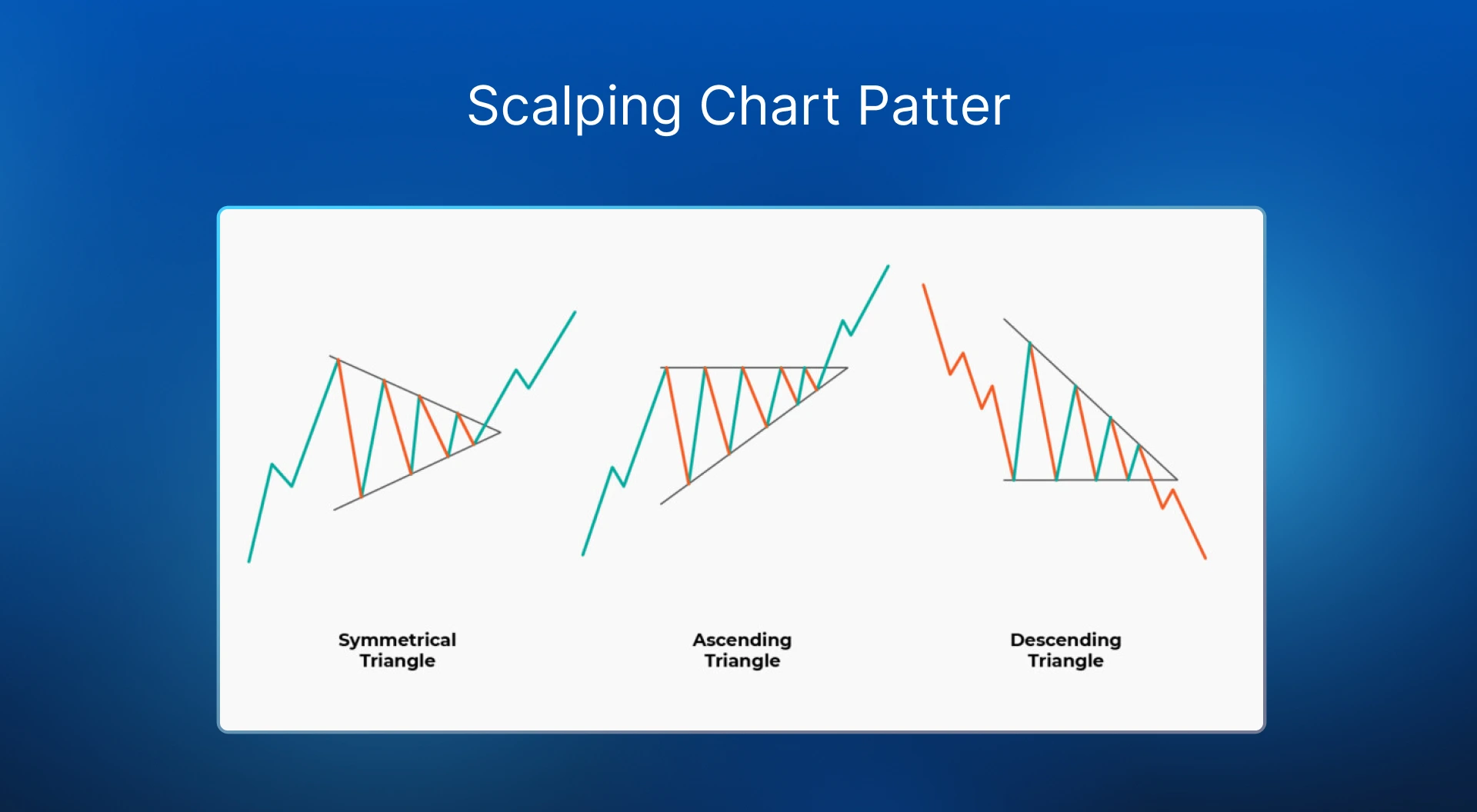

Scalping Mastery for Funded Accounts

Scalping in prop trading environments requires a completely different approach than the frantic clicking many traders associate with this strategy. Professional scalping combines technological advantages with systematic execution to generate consistent small profits that compound into significant gains.

High-Frequency Precision depends entirely on execution quality and timing. Successful prop scalpers focus on major currency pairs during peak liquidity hours when spreads are tightest and market depth is greatest. This approach minimizes transaction costs while maximizing the probability of favorable fills.

The strategy works because it exploits temporary price inefficiencies that exist for seconds or minutes rather than betting on longer-term direction. Think of it like arbitrage – you're capturing small price discrepancies rather than predicting market movement.

Technology Integration makes the difference between profitable and unprofitable scalping. Success requires low-latency platforms, reliable internet connections, and automated execution systems that can capitalize on brief opportunities before they disappear.

Platform selection becomes crucial. MetaTrader platforms often lack the execution speed required for competitive scalping, while specialized platforms like cTrader or DXTrade provide the millisecond execution times that scalping demands.

Risk Management Automation becomes essential when executing dozens of trades daily. Manual risk management simply cannot keep pace with high-frequency trading, making automated systems mandatory for consistent results. Maximum loss per trade typically ranges from 0.1% to 0.3% of account value, requiring precise position sizing and tight stop losses.

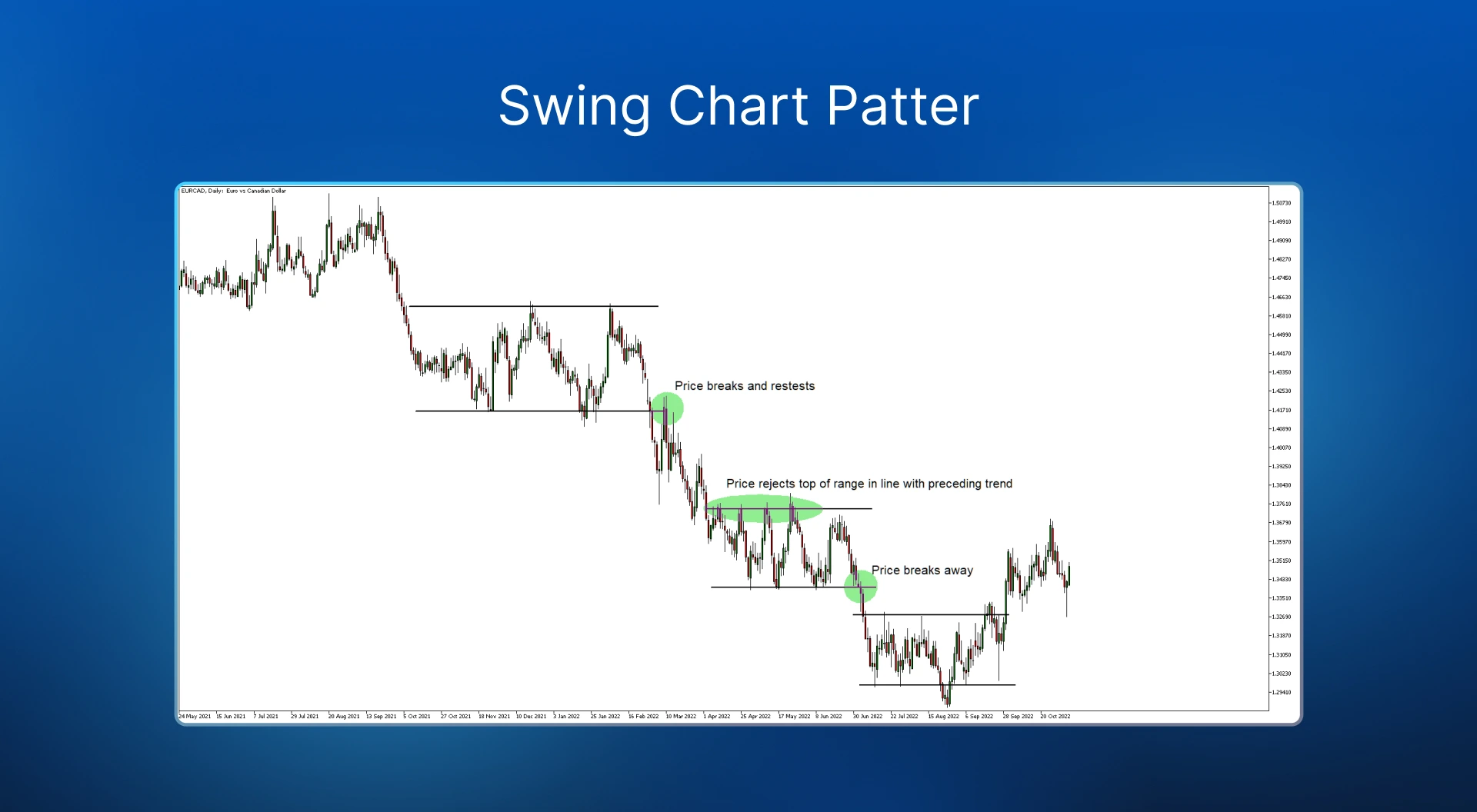

Swing Trading Excellence

Swing trading offers the most sustainable approach for many prop traders, providing excellent risk-adjusted returns without the stress and technical requirements of scalping or the patience demands of long-term position trading.

Market Context Analysis begins every successful swing trade. Instead of focusing purely on technical patterns, professional swing traders understand broader market conditions, economic cycles, and sentiment trends that influence intermediate-term price movements.

This analysis combines fundamental factors like central bank policies, economic indicators, and geopolitical events with technical analysis to identify markets likely to trend over several days or weeks. The key is understanding that swing trading succeeds by capturing portions of larger moves rather than trying to perfectly time market tops and bottoms.

Setup Identification follows systematic criteria that eliminate emotional decision-making. Successful prop swing traders develop specific checklists for trade qualification, ensuring every position meets predetermined standards for risk-reward ratios, technical confirmation, and market context alignment.

A typical swing trading setup might require: clear trend direction on weekly charts, oversold/overbought conditions on daily charts, confluence of support/resistance with Fibonacci levels, and momentum divergence suggesting trend continuation or reversal.

Portfolio Approach allows swing traders to diversify across multiple positions and timeframes, reducing overall portfolio risk while increasing profit opportunities. Instead of putting all capital into single trades, successful prop swing traders might maintain 3-5 positions across different markets and timeframes.

News Trading: High-Risk, High-Reward Mastery

News trading represents the Formula One of prop trading strategies – exciting, profitable for skilled practitioners, but dangerous for inexperienced participants. Success requires combining economic analysis, technical precision, and risk management discipline that many traders lack.

Economic Calendar Mastery begins with understanding which events actually move markets versus those that generate headlines without price impact. Professional news traders focus on central bank announcements, employment data, inflation reports, and geopolitical developments that historically create sustained price movements.

The key insight is that market reaction depends more on surprise factor than absolute numbers. A "bad" economic report that's less bad than expected often generates positive price reaction, while "good" news that disappoints expectations can trigger selling.

Pre-Positioning Strategies allow traders to capitalize on anticipated volatility without trying to predict exact direction. One effective approach involves placing pending orders above and below current price levels before major announcements, with the expectation that one order will trigger during the volatility spike while the other is cancelled.

Risk Control Systems become absolutely essential because news trading can generate large profits or losses very quickly. Automated systems that limit maximum loss per trade and maximum daily exposure help prevent single events from ending trading careers.

Risk Management: The Foundation of All Strategies

Risk management in prop trading transcends simple stop-loss placement, encompassing comprehensive systems that protect capital while enabling consistent profitability. Understanding these systems often determines success more than strategy selection itself.

Drawdown Prevention requires mathematical precision rather than emotional decision-making. Successful prop traders calculate their maximum position size based on account value, risk tolerance, and stop-loss distance using fixed formulas that remove subjective judgment from critical decisions.

Most prop firms allow 5-12% maximum drawdown before account termination, but successful traders treat these limits as absolute boundaries rather than targets to approach. Operating with maximum 2-3% drawdowns provides sufficient buffer for unexpected market movements while maintaining good standing with funding firms.

Daily Loss Limits provide circuit breakers that prevent single bad days from destroying weeks or months of profits. Many prop firms impose daily loss limits ranging from 3-5% of account value, automatically closing all positions when limits are reached.

Rather than viewing these limits as restrictions, successful traders use them as risk management tools that enable more aggressive trading within defined boundaries. The key is setting personal daily limits below firm requirements, providing early warning systems before automatic shutdowns occur.

Strategy Diversificationacross timeframes and approaches reduces overall portfolio volatility while increasing profit opportunities.

Psychology and Performance Optimization

The mental aspects of prop trading often determine success more than technical knowledge or strategy sophistication. Understanding and managing these psychological factors provides significant competitive advantages.

Pressure Management becomes crucial when trading significant capital with strict performance requirements. The knowledge that poor performance means losing access to funding creates pressure that can interfere with normal decision-making processes and strategy execution.

Successful prop traders develop routines that normalize funded trading experiences while maintaining awareness of additional responsibilities. This might include beginning each session by reviewing rules and limits, using position sizes that feel comfortable rather than maximum allowed, and maintaining detailed trading plans.

Confidence Building through systematic approach development provides sustainable foundations for long-term success. Rather than relying on hot streaks or individual trade results, successful prop traders build confidence through repeatable processes that generate consistent results over time.

Performance Tracking provides objective feedback that guides strategy refinement and psychological development. Many successful prop traders maintain trading journals that go beyond simple profit/loss records to include market analysis, strategy execution notes, and psychological observations.

Building Your Strategy Framework

Success in prop trading requires more than selecting individual strategies. It demands developing integrated approaches that work within prop firm constraints while providing sustainable competitive advantages.

The most effective prop trading strategies share common characteristics: mathematical position sizing that prevents catastrophic losses, systematic entry and exit criteria that remove emotional decision-making, risk management systems that keep drawdowns well within firm limits, and psychological frameworks that maintain performance under pressure.

Ready to implement these proven prop trading strategies? Explore Toptier Trader's evaluation programs and start building your funded trading career with professional support and institutional-grade trading conditions.